Market Sizing: A Simple Step-by-step Guide

Establishing market size is critical to understanding a company’s growth potential. This data point is useful in a multitude of ways. It is often one of the first questions an investor will ask. It also steers business decisions on product development, marketing, and business strategy.

In this article, we explore how to do market sizing, including what it is, why it’s important, and steps to establish market size. To illustrate this, we will specifically look at how to do market sizing for B2B tech companies.

What is market sizing?

Market sizing is how you estimate the total size of a commercial sector. It is a numerical calculation that is often based on factors including revenue, sales volume, the number of customers, pricing, and competitor benchmarking. This requires making some assumptions about a market, which can introduce bias.

How to do market sizing

Market size is calculated in one of two ways:

Top down market sizing

Top down market sizing relies on secondary sources of data, such as industry reports and desk research on competitors. A B2B technology company specializing in data analytics software for financial services companies might look at industry reports on the overall size of the fintech market. It would then estimate the percentage of the market that matches its target audience and product.

This is a quick and cheap way to get a ballpark number for market size. It is a great way to get a sense-check at the early planning stage for a potential market opportunity. However, since it relies on broad assumptions, there is a greater risk of inaccuracies.

Bottom up market sizing

By contrast, bottom up market sizing is a more precise method of market sizing. It involves aggregating individual customer data to estimate the overall market size. This is often achieved with market research methods that use primary sources of data, including quantitative surveys and customer data.

For instance, if a B2B tech company knows that its average customer spends $50,000 on software services a year, and that there are 2,000 relevant organizations in its category, then the estimated total market size is $100 million.

The bottom-up approach to market sizing provides a more accurate estimate as it is based on real customer data. This is more convincing for investors and other stakeholders. However, it is also more costly and time-consuming, as it requires collecting primary data, which requires greater investment from the company.

Market size formula

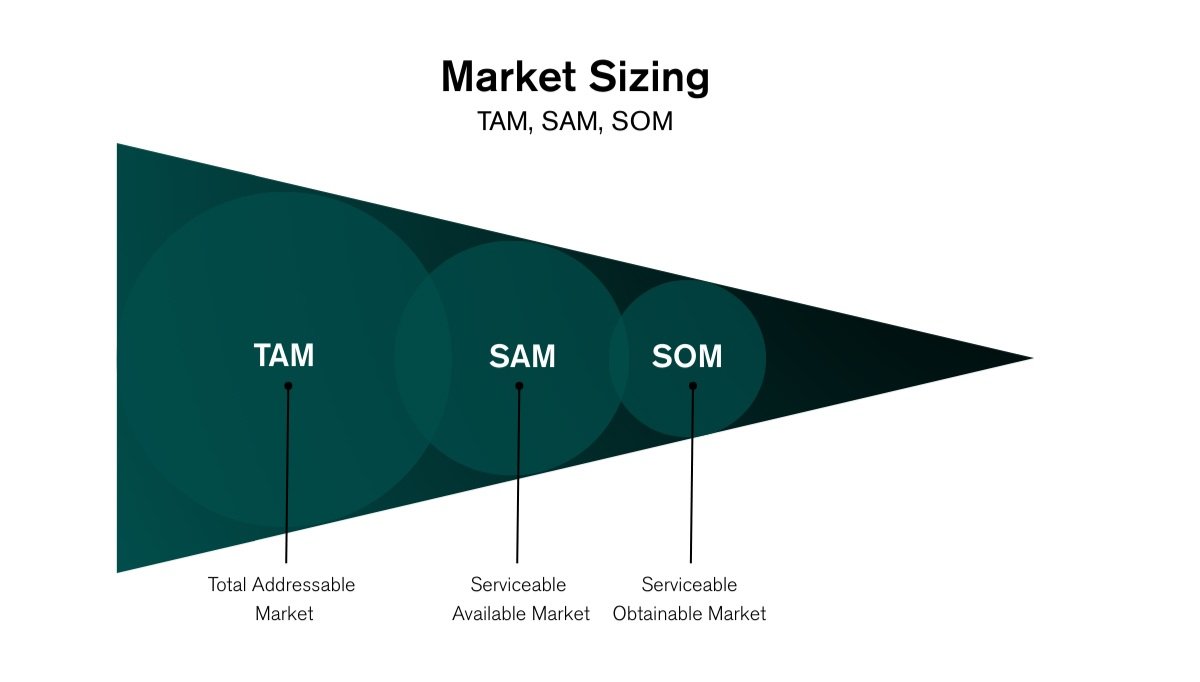

There are three bottom up market size formula that are commonly used in market research: Total Addressable Market (TAM), Serviceable Available Market (SAM) and Serviceable Obtainable Market (SOM). We explore each of these below.

Total Addressable Market (TAM)

The Total Addressable Market (TAM) is the total revenue opportunity available if your product or service were to achieve 100% market share. To calculate the Total Addressable Market, multiply the total number of potential customers by the average revenue per customer.

For example, if there are 1,000 potential businesses that could use your software and the average company spends $10,000 annually on such software, your Total Addressable Market would be $10 million.

In almost all cases, it’s unlikely that a company would have 100% of market share. Even if a company is a first mover in the market, it is often competing against legacy services and solutions. For that reason, it is often more valuable to calculate the Serviceable Available Market (SAM).

Serviceable Available Market (SAM)

The Serviceable Available Market (SAM) is the segment of the Total Addressable Market that a company can realistically target.

The method to calculate the Serviceable Available Market is more complex as it is based on compensating for additional factors, some of which can be subjective. This could include estimations about your geographic reach, brand awareness, product capabilities, product-market fit, and ideal customer segments. An investor will often want to see the workings for how you came to conclusions about these factors.

Serviceable Obtainable Market (SOM)

In addition to this, the Serviceable Obtainable Market (SOM) is an estimation the market share that you can realistically capture in the near term. This is a more focused subset of the market, where you have a competitive advantage or a unique value proposition. It is also useful when there is a minimum requirement or limiting factor for customer engagement.

A step-by-step guide to market sizing

There are a number of steps to market sizing. Here is a step-by-step guide based on how to do market sizing for a B2B technology company:

Step 1: Define Your Market

The first step is to define the target market. This includes the industry, geographic location, customer size, and sector of your target customers. For instance, if you were a SaaS provider with a financial services product, you might want to calculate the total revenue of SaaS companies providing solutions to financial services firms in the United States.

Often, B2B tech companies will hire a B2B market research agency to help define its target audiences and their specific needs with a B2B segmentation study. This breaks down a target market into specific customer groups and identifies their specific needs, behaviors and attributes, and what proportion of the target market they account for.

Step 2: Calculate the Total Addressable Market (TAM)

The next step is to calculate the Total Addressable Market (TAM). This is the total revenue generated by companies in the target market segment. It is based on the number of potential customers multiplied by average revenue.

Total Addressable Market = Total Potential Customers x Product x Price

For example, a B2B technology company selling a SaaS product to financial services companies in the U.S. would estimate that there are nearly 12,000 financial institutions in the U.S. based on FDIC and NCUA data.

Primary research has identified that financial service companies have an average of 5 subscriptions of relevant SaaS products at $10,000 per seat. As such, the calculation for the Total Addressable Market is:

12,000 U.S. financial services companies x 5 subscriptions x $10,000 = $600 million

B2B market research companies will often use desk research to calculate the number of potential customers and their average revenue. This helps to triangulate the TAM figure. In some cases, this information is available through public sources of information, such as directory lists or industry reports. They can also conduct a quantitative survey of potential customers that will ask them for an estimate of their company’s annual revenues, their product and solution usage habits, and spend, among other factors.

Step 3: Identify the Serviceable Available Market (SAM)

After calculating the Total Addressable Market, the next step is to narrow it down to the Serviceable Available Market (SAM). This is the segment of the Total Addressable Market that your company can realistically target.

B2B market intelligence research conducted by a B2B market research company helps to explore market trends and pinpoint what is important to your target customers. This is often used to identify where customer needs aren’t being addressed and provide initial guidance on the nature of the opportunity.

Brand awareness research can also benchmark your brand awareness, how your brand performs against certain attributes, and your market penetration and average share of wallet versus competitors.

For example, the B2B technology company from the above example conducts a market feasibility analysis and brand health study. It knows that its product requires specific technical infrastructure and operating systems to run, which only half of the financial services companies have. This would divide its Total Addressable Market in half to a Serviceable Available Market of 6,000 companies or $300 million in revenues.

Step 4: Calculate the Serviceable Obtainable Market

Of the 6,000 companies, the B2B technology company may identify 500 that are an ideal fit for its solution. Based on a customer needs assessment, it estimates that it can sell double the number of subscriptions to those companies and at a higher price. In this case, its Serviceable Obtainable Market would be 500 customers or $75 million in revenue.

500 ideal-fit financial services companies x 10 subscriptions x $15,000 = $75 million

Step 5: Address Potential Barriers to Entry

Once you have your Serviceable Available Market and Serviceable Obtainable Market, it is important to identify and address any potential barriers to entry or growth. This can be drawn from a brand equity study or competitor benchmarking research, which evaluates a brand’s strengths and weaknesses, and how they can be addressed.

Potential investors often want to see a plan for how a B2B tech company will proactively address any competitive weaknesses. By proactively tackling any issues with their product, customer experience and brand messaging, B2B tech companies are also more effective in growing their market share.

For instance, the example B2B technology company may have a strategy to improve its brand awareness and positioning to compete with an incumbent brand that captured 50% of the existing market, or a strategy to serve customers in a new region by opening a local sales office.

Step 6: Validate Your Assumptions

B2B tech companies make various assumptions and estimates when calculating market size. It is important to compare this to historical data, industry benchmarks, and expert opinions. This can highlight if the market sizing data is erroneous – for instance, if the Total Addressable Market is bigger than the GDP of the overall B2B tech sector.

Market sizing questions

Here are some market sizing questions that a B2B market research company might survey customers with:

- What is your company’s annual revenue?

- How many employees does your company have?

- What specific products or services do you currently use in your operations?

- How much do you spend annually on these products or services?

- What geographic regions do you operate in?

These market sizing questions are designed to gather insights into company size, spending habits and market potential. The data forms the basis for market sizing calculations.

In addition, it might ask marketplace intelligence questions about the customer’s needs and attitudes toward certain products and brands to assess whether there are any unmet needs. It also identifies which brands are seen as leaders vs laggards. This helps a company to formulate a clear go-to-market strategy, on top of knowing the market size.

Challenges in market sizing in B2B technology

Market sizing for B2B tech companies is not easy. The B2B tech industry is complex and evolving rapidly. New technologies and emerging players can dramatically alter the commercial viability of a product or service in a short period of time.

B2B tech market sizing is often hampered by the following factors:

- Availability of public data: Public data sources often lack detail or are limited in niche or emerging markets, which is often the case for B2B technology.

- Researching niche audiences: Interviewing expert decision-makers in B2B technology markets is challenging. They can be reluctant to share commercially sensitive information, such as revenues or spend.

- Rapid Market Changes: B2B technology markets evolve quickly, making it difficult to maintain up-to-date market size estimates. The number of customers or size of revenues can change, and M&A can rapidly shift market dynamics.

- Assumption Risks: Market sizing relies on assumptions that may not always hold true. B2B technology companies may be biased in these assumptions, focused on their largest accounts rather than the long tail of potential customers, or tempted to overestimate their market size to impress potential investors.

Why is market sizing important?

Market sizing is important in the following three scenarios:

Identifying market opportunities

Market sizing helps companies to identify potential market opportunities. In some cases, the Serviceable Available Market may be too small for a product or service to be commercially viable.

It can also identify where to focus resources and efforts by prioritizing market segments with the highest potential for revenue growth. Market opportunity research can provide additional detail on how to formulate a go-to-market strategy.

Product development research

By knowing the Serviceable Available Market, a company can estimate the potential demand for its product. Ensuring that there will be a receptive audience is the first step in developing a product that meets the needs of the market. Product development research further identifies what attributes and pricing resonate best with customers.

Fundraising from investors

Market sizing is one of the first questions that an investor will ask a company to provide. It is a key data point that is often included in a fundraising pitch deck or company sale portfolio. Investors use market sizing to evaluate the potential growth and profitability of a company.

A larger market size suggests the potential for a higher return on their investment. However, they will also consider other factors, such as market share, which is why calculating the Serviceable Available Market and Serviceable Obtainable Market is important.

Companies need to show their assumptions and calculations for market share. It is also important to outline a business strategy to grow market share that accounts for a brand’s strengths, weaknesses, opportunities and threats, versus its competitors.

Summary: Market sizing is imperfect, but often necessary

When it comes to how to do market sizing, there is no easy solution. Calculating market size involves making estimations about customers and their respective spend and revenue generation potential across different geographies and segments. This can be hard to pinpoint accurately, especially in highly technical and rapidly evolving sectors like B2B technology.

However, despite the downsides, knowing the market size for a product or service is often critical. This is especially the case when a company is looking to raise capital, launch a new product, or identify target customer segments. By understanding the size and dynamics of a potential market, companies can make informed decisions about where to focus resources and the potential return on investment.

Companies should look to minimize the risk of errors by corroborating market size calculations with existing public data, where available. In addition, a B2B market research firm can help by collecting primary data to inform market sizing calculations. These firms can also help by conducting a market opportunity study, segmentation, brand awareness assessment or pricing research to provide companies with more tangible insights into how to formulate a go-to-market strategy or grow their market share.

Capabilities

Construction Materials Company Drives Growth Through Improved Customer Experience

A construction materials company wanted to drive growth through improving its customer experience among its customer base of industrial manufacturers and installers. The...