Go to Market Strategy Consulting: How Research Informs a GTM Strategy

Market research is the backbone of effective go to market strategy consulting. By talking to potential customers, you gain a deeper understanding of their needs and the market landscape. These insights inform a GTM strategy and are critical to achieving business success by allowing companies to better target customers and optimize their offerings.

What is a Go-to-Market (GTM) Strategy?

Before we get into how to conduct market research, let’s first outline a go-to-market strategy – what it is, and when you need one.

A Go-to-Market (GTM) strategy is a detailed plan that directs a company on how to deliver its unique value to customers. At its core, it outlines how a company will introduce its products or services to the market. This involves identifying target audiences, understanding competition, and setting clear sales, marketing, and distribution channels.

Several key components define a GTM strategy:

- Target audience identification

- Unique value proposition

- Distribution, sales, and marketing channels

- Pricing strategy

A GTM strategy is necessary if you are planning to launch a new product or service, looking to improve or change a product/service, or want to enter into a new market – whether that is geographically or demographically.

For example, a company selling nails to deck contractors developed a new adhesive product. It needs a GTM strategy to refine the product features, and determine how best to market and sell the new adhesive to contractors. In essence, the strategy is a clear roadmap on how to enter the market. This includes what product features to focus on, how to price the product, and what marketing or sales strategy will resonate with the target audience.

What is the role of market research in a GTM strategy?

Sometimes, a company will have a good hunch that there could be unmet demand for a product or service. Perhaps there are well-known pain points in the industry, or maybe customers have asked for something directly from sales reps or through an online feedback form.

However, going to market with an idea that is untested and unrefined is risky.

Launching a new product or service is often a major capital investment for a company, and therefore a significant risk on its balance sheet. Before taking the plunge, executives need to be confident that the idea has legs, and that the go-to-market approach will be a success. A poorly executed GTM strategy could result in material losses for the company and have a negative impact on its reputation and stock price.

That’s where market research comes in. It is used to find out three things: one, does the idea work in a real-world scenario? Two, will it be a success? And three, if so, what factors are essential for that to happen?

The answers to these questions can be uncovered through qualitative and quantitative research with customers in your target market. It gathers data points on competitors, market trends and consumer behavior to build a comprehensive picture that is not biased by personal preference. The result is a clearly defined GTM strategy that reflects the realities of the market.

How to conduct market research

Researchers use a range of market research methodologies to gather insights that can inform go to market strategy consulting. A custom approach can combine both qualitative and quantitative techniques, such as focus groups, ethnographic observations and structured interviews.

Key insights from market research can include:

- Customer preferences, unmet needs, and pain points

- Competitive landscape analysis

- Emerging market trends

- Willingness to pay and price sensitivity

- Potential barriers to market entry

Market intelligence

Market intelligence research assesses the competitor landscape, the market opportunity, and provides an assessment of product-market fit. It outlines all the factors that are fundamental to successful market entry or product launch, from what to offer, how to communicate value, and how to reach your target audience.

At a basic level, market research is used to pinpoint customer preferences and trends for go to market strategy consulting. What do customers like? What don’t they like? Are your competitors meeting those needs? By identifying these customer trends, and strengths and weaknesses of competitors, market research maps out the potential opportunity for your product or service. It is also used to develop your value proposition: a clear message that resonates with target audiences.

At a more advanced level, a market simulation (e.g., of interest, demand, and willingness to pay) helps to predict the impact of a go-to-market strategy based on business KPIs.

Market segmentation

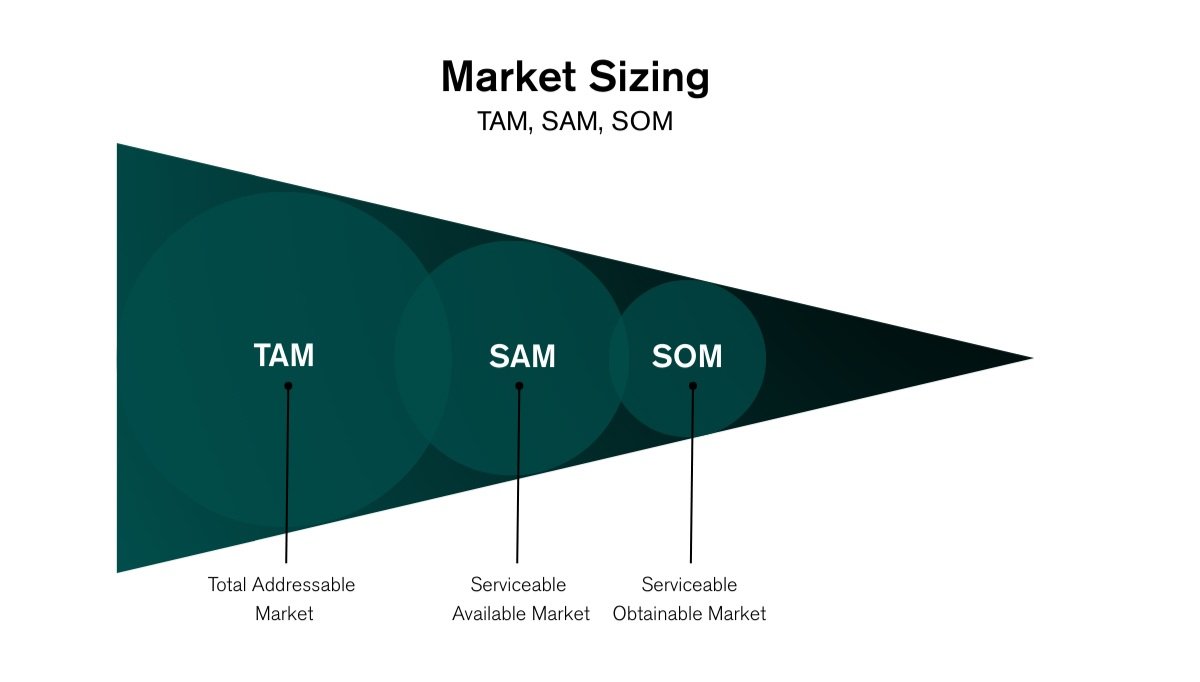

A market segmentation is useful for gaining a deeper understanding of distinct customer groupings, or segments, in a target market. This includes the Total Addressable Market, Serviceable Available Market, and Serviceable Obtainable Market. Segmentations can be based on geographic, and demographic/firmographic factors, and customer needs, attitudes, and behaviors.

A segmentation reveals key insights about your target audience, including:

- Value drivers: A deeper understanding of what drives purchasing decisions in different customer segments

- Marketing strategy: Identifying the most effective marketing messaging and distribution channels to reach customers

- Buyer personas: Characterizations of the ideal customer profile

Market segmentation powers a more effective go-to-market strategy for new products and services by informing optimal offers, best-fit segments, and optimized messaging and targeting strategies.

Product development

Product development research gathers feedback from potential customers on whether product features meet their needs.

It often starts with a focus group where a small group of potential customers are asked qualitative open-ended questions about a product. They provide feedback on which features they do and don’t like, and why. Researchers try to uncover subconscious motivations for why customers prefer a particular product or brand, and what could be done to improve it.

In some cases, a research firm may conduct ethnographic research as part of product development research. It involves observing customers interacting with the product or service in their everyday lives. This may involve a product demonstration, particularly if a company wants to test out a prototype or beta version before releasing it to the market. Demonstrating the product first-hand helps to identify flaws, strengths, and unique selling points in a real-world setting, which can be used to refine the product and marketing strategy.

Qualitative research alone can be used to inform the GTM strategy. However, a rigorous quantitative study validates and builds on these findings. A small sample, like a focus group, may not represent what the wider population thinks, and so a quantitative study tests these hypotheses with a wider audience. It is based on structured interviews with a representative sample of the target market.

Pricing

Pricing research pinpoints the price that customers are willing to pay and provides a pricing strategy that derives maximum profit and/or demand. The data is analyzed using tools like Van Westendorp Price Sensitivity Meter to identify the acceptable price range, the indifference price point, and the points of marginal expensiveness and cheapness. Using this research, companies structure pricing for their products, including bundles, special offers, and subscriptions.

Why quality matters in market research

The importance of data validation

Online surveys are vulnerable to fraud – without validating the respondent’s identity, it is almost impossible to know if they are a real person who is in your target market. Market insights based on fraudulent data can misguide a go-to-market strategy, increasing the odds of failure.

There is a real cost to this since companies are often putting significant capital on the line. Products that don’t sell as well as they should diminish profits and have a negative impact on investor sentiment. Wasted time and resources are a drain on a company’s bottom-line and lead to low morale among employees.

In the long run, failure to meet the evolving needs of customers and lower morale can lead to deeper turmoil in a company, including loss of market share and even bankruptcy. That is why go-to-market strategies backed by accurate market research based on real data and clear insights are vital.

Werk Insight, a B2B market research agency, believes that the best method for quantitative data collection is using CATI (computer-aided telephone interviews) conducted via phone or video conferencing software. That way, a participant’s identity can be validated with ID or a business email address.

Designing an effective research study

Beyond data validation, the research study needs to be designed to capture representative views of the target market. A well-designed study mitigates the risk of bias and unearths valuable insights that are the foundation for successful go-to-market strategy consulting.

Here are the key components for a successful market research study:

- It uses an effective combination of qualitative and quantitative research methodologies, where appropriate, to uncover valuable insights about your market, product and customers. The research design is unique to each scenario, depending on the research objectives, customer profile, industry landscape, and product.

- Discussion guides and questionnaires are worded to minimize the risk of bias.

- A representative sample, where feasible, of real customers in your target market. It may not be possible to reach a representative sample for a quantitative study in niche markets if the budget doesn’t allow for it. However, qualitative research still provides useful insight into customer preferences.

- For quantitative research – validated data collected through phone or video interviews using computer-assisted telephone interview (CATI) software, with the respondent’s identity confirmed with ID or a business email address.

- For qualitative research – a broad mix of customer profiles, and an experienced moderator who can draw out insights and manage interactions in a focus group setting to prevent one voice from being too dominant.

- Expert analysis of the data to identify real trends and patterns, without misconstruing the findings. It often requires a researcher who is confident in using statistics and advanced analytics with large data sets to avoid introducing bias at this stage.

- Clear communication of the findings, and what actions the company needs to take to achieve success.

Conclusion: The benefit of go to market strategy consulting grounded in research

Go-to-market strategy consultants lean on their industry knowledge to build a go-to-market strategy that is robust and agile. They provide custom guidance to the client on what actions to take to meet business objectives, whether that is entering into a new market or launching a product.

However, no two go-to-market strategies are the same. Precise and objective market research conducted by a third-party consultant, such as a B2B market research agency, is the key to success. Investing in research at this stage pays off by increasing the likelihood that a product or market entry reaps returns for the investment in time and money. Go to market strategy consulting that uses market research empowers businesses to make confident decisions and achieve a competitive advantage.

Construction Materials Company Drives Growth Through Improved Customer Experience

A construction materials company wanted to drive growth through improving its customer experience among its customer base of industrial manufacturers and installers. The...